Open this if you want to understand WHY the Government has NO CHOICE but to print money and stimulate the economy….

Hey everyone!!

Wanted to do an ECON 101 letter today.

I’m going to do this the best way I know how… -> SIMPLE :)

I always wondered 2 things…

1) WHY does the Government keep endlessly printing money out of thin air?

2) What are the warning signs, so we can see when they are about to print more?

Here’s my understanding of it, I’m not one of those Harvard Professors so bear with my analogies please :)

I just tweeted this out this morning…

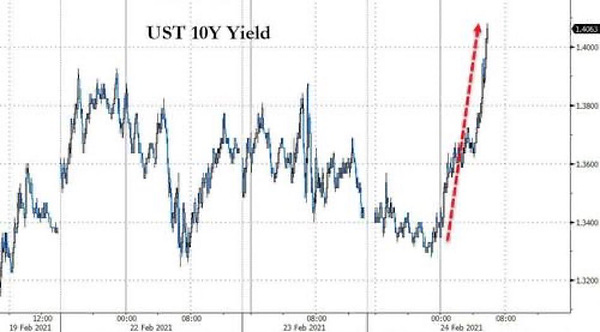

THIS GRAPH IS IMPORTANT SO CHECK IT OUT.

As you can see from the graph, there has been a SPIKE on the US Treasury 10 Year Yield.

Now, I KNOW trust me, most of you are like, “WHAT THE HELL IS A US TREASURY 10 YEAR YIELD”.

Don’t feel bad, that’s exactly how I felt a year ago.

I’m going to explain this SO SIMPLY, but here’s the TLDR: Whenever that yield goes UP? The Government prints money. It’s that simple.

Okay so first, what is a treasury?

Think about the Government like a REALLY badly run business.

Like horribly bad.

Like “they would have been out of business 100 years ago if they didn’t own all the bombs,” bad.

Pretty much every single year, they SPEND more money than they MAKE.

But wait, how does the Government make money anyway?

Taxes. They get it from the people.

HOWEVER -> those taxes NO LONGER come even close to covering their spending.

Not by a long shot.

So, they need to take out DEBT in order to pay for things (like roads and schools and aircraft carriers and massively inflated salaries for incompetent senators :))

A TREASURY is what the government uses to take out debt.

If you or I want a loan, we go to the bank, right?

If the government wants a loan, they issue a TREASURY, which is basically just a note saying, “I agree to pay you X amount of interest over X time, in exchange for X dollars”.

So, for instance, if they want to spend a Billion dollars on their newest stupid idea, the Government can issue a Billion dollars of treasuries, and dangle some INTEREST RATE as an incentive for people to give them that money…

Make sense?

Amazing.

But wait, what does 10 year yield mean?

Glad you asked.

10 year is just the time frame.

Yield, is the interest rate (how much you would make for loaning the government your money).

Here’s where it gets juicy, okay?

Those interest rates used to be GREAT!

As early as 20 years ago you could make 5-10% RISK FREE on any dollar you had saved up, depending on how long you loaned it to the Government.

Obviously, this was a great deal, particularly for OTHER GOVERNMENTS and BANKS, who also want to make money and have a lot of money to spend.

So they were buying up these treasuries like wild fire!!

It was basically like…

“HEY! YOU HAVE BILLIONS JUST SITTING AROUND? GIVE THEM TO US AND WE WILL PAY YOU 10% FOR DOING NOTHING AND KEEP THEM SAFE FOR YOU! WIN WIN!”

But now, oh, have things changed….

That’s the 10 year yield….

yikes, right?

So much for a “free lunch”.

Those days are OVER….

Ever since 1980, the interest rate has literally fallen off of a cliff.

This is 100% a symptom of DEBT.

In very simple terms, as the US gets MORE and MORE in DEBT, they can’t AFFORD to pay any more interest!

It makes sense right?

If you were $1,000 in credit card debt…

You could probably afford a few hundred bucks in interest….

But if you were $1,000,000 in debt?

Not so easy to pay that interest, right?

That’s exactly what has happened, but at a GLOBAL scale….

Okay, I lied, here’s where it ACTUALLY gets juicy.

Imagine you are China, or a big bank, or whatever.

You’ve been loaning money to the U.S.A. for YEARS!

and they always paid you 20%.

Then it was 15%…

then 10%…

then 5%…

How soon would you say, screw this?

I’ll answer that for you…

(a few years ago).

Basically, because interest rates are now at ZERO (and have gone NEGATIVE in many countries) there is now NO incentive for ANYONE to buy them!

Why the heck would I lock my money up for 10 years, for a zero percent return???

You’d have to be insane!!!!

So, that begs the question, how does the U.S. pay for all its debt?

If no one is buying treasuries, that means that they have no money to pay for anything.

Taxes ain’t covering it, remember?

So, who buys them??

AND HERE COMES THE MOST FAMOUS MEME OF ALL TIME….

That meme has gone insanely viral, because it’s so true.

The central bank (in the U.S. we call it the “Federal Reserve”) steps in and BUYS all the treasuries.

Now, you should be thinking… WTF?

How can one part of the government buy stuff from another part of the government?

That doesn’t even make any sense!!!

How do they even have money to buy things, I thought the whole point was that they don’t have any money to begin with!!!

Exactly.

You are a smart one…

They don’t have money, they print it out of THIN AIR.

See, the Federal Reserve has a magic computer.

With a single keystroke, they can manufacture as many dollars as they want.

Because this whole treasury thing is super complicated, most people don’t realize what they are doing, but it’s simple as that.

It’s like if you or I..

Normal people…

Instead of paying our credit card debt…

We went on a magic computer.

Hit one button…

And sent dollars over to our credit card to pay it.

That’s literally what they are doing….

Hey if your mind is blown right now I’d encourage you to share this with someone or subscribe for heaven’s sake it’s free for 30 days…

Okay okay okay so what does this have to do with what I said at the beginning?

The INTEREST RATE on these TREASURIES is going UP, not DOWN, why would this mean that the Government is going to print more money?

But that’s the thing, remember?

In the past, maybe a rising interest rate would have encouraged OUTSIDE buyers to come in and bail out the U.S.

Unfortunately, those buyers are LONG GONE.

They aren’t coming back.

That bridge has been burned.

So, if interest rates go up, the Government is LITERALLY just shooting itself in the foot!!!!

ALL of its debt gets MORE expensive, and MORE impossible to pay off.

If those rates go up, it becomes EVEN MORE obvious that we are living in a ridiculous monopoly World that makes no sense!!!

How can people be hoodwinked into believing that this debt will get paid off, if the Gov can’t even pay the INTEREST on the debt, much less the principle!

No, that won’t do, that won’t do at ALL!

That’s why the tweet above is WITHOUT A DOUBT the most SURE indicator that more stimulus is INCOMING, and INCOMING SOON.

If those rates spike even a LITTLE BIT, everyone in the Federal Reserve gets cold sweats and night terrors, no joke.

So, look out for more funny money entering the system, asap!

And watch the prices of ASSETS!

Businesses

Bitcoin

Rare Art

Stocks

Anything with ANY scarcity to it will continue its rocket ship upwards.

CONGRATULATIONS! YOU NOW UNDERSTAND THE INNER WORKINGS OF THE MONOPOLY GAME WE ALL LIVE IN!!!

If you learned more in the last 10 minutes than you learned in your entire college education you probably owe it to yourself to subscribe.

It’s free for 30 days.

And I know a bunch of teachers and educators and smarter people than me read this.

So share it with your students for the love of Pete. They need to know how this crazy system works.

See you tomorrow

Kale

Share this post